What is the best site to get a free credit report: Your credit history holds significant importance in shaping your financial well-being. It serves as a crucial tool for lenders to evaluate your financial reliability.

In essence, your credit report documents your previous borrowing and repayment activities. Upholding a positive credit history is essential for accessing loans and various financial opportunities.

What is a credit report?

Although the term ‘credit report’ is familiar to many, not everyone grasps its full importance and complexity. Whether you’re new to financial matters or simply in need of a review, it’s essential to understand the components of a credit report.

Essentially, a credit report, also referred to as a “credit file,” provides a comprehensive overview of an individual’s credit behaviors and history. Consider it akin to a financial report card that lenders and creditors scrutinize to assess your creditworthiness.

click here – Chase Private Client Bonus: $3,000 Cash Offer Promotion

Key Components of a Credit Report:

– Personal Information: This section includes details such as your name, address, Social Security number, date of birth, and potentially employment information.- Credit Accounts: It provides a comprehensive list of your credit accounts, encompassing credit cards, mortgages, car loans, and other types of loans. Information within this section includes the account opening date, credit limit or loan amount, current account balance, and your payment history.- Inquiries: This segment reveals instances where lenders or businesses have requested access to your credit report, typically occurring when you apply for credit.- Public Records: Information sourced from state and county courts, such as bankruptcies or tax liens, may be documented here.- Collections: Any debts that have been transferred to a collection agency are listed in this section.Each account featured in your credit reports indicates its establishment date, payment history, credit limit, and account type (such as mortgage, installment, revolving, or collection).These reports are compiled and managed by three major credit reporting agencies or bureaus: Equifax, Experian, and TransUnion. Given that each bureau may access different sources of information, it’s crucial to review reports from all three agencies to ensure accuracy.

Nationwide Credit Bureaus: Their Role and Significance

Experian, Equifax, and TransUnion, the three major credit bureaus operating nationwide, act as custodians of your credit data. They gather and manage information concerning consumers’ credit activities, serving as crucial references for lenders, employers, and various entities to assess creditworthiness.

How do I get my free annual credit report?

According to the Fair Credit Reporting Act (FCRA), federal law grants you the right to receive a complimentary copy of your credit report once every 12 months from each of the three major credit bureaus: Experian, Equifax, and TransUnion. Additionally, certain states offer an extra free report annually, including:

- Colorado

- Georgia

- Maine

- Maryland

- Massachusetts

- New Jersey

- Vermont

Your free annual credit reports provide the same account details as a paid report, encompassing your active and closed credit accounts, along with your payment history for each. Typically, this includes payment records for loans, credit cards, and revolving lines of credit. Additionally, if you rent an apartment, you may find information regarding rental payments.

click here – Citi Regular Checking (Formerly Citi Basic Banking Package) Review

How do I order my free credit reports?

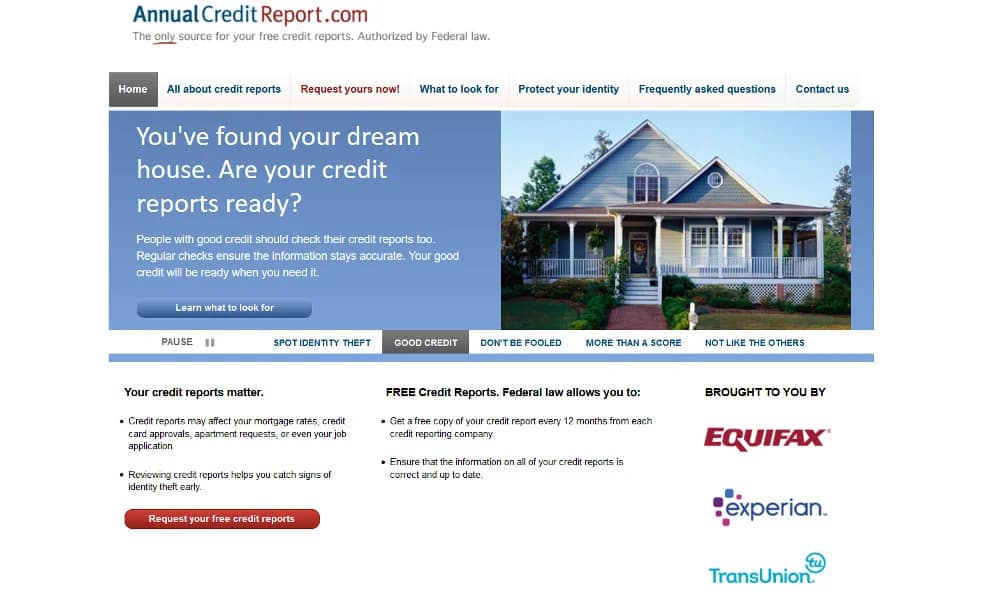

When obtaining your complimentary annual credit reports, you can conveniently request them online via AnnualCreditReport.com. This platform enables you to order all three of your free credit reports simultaneously, without any obligations or hidden charges. While you may need to provide personal details to verify your identity during the ordering process, there won’t be any charges associated with using this website.

If you utilize these free credit reports to initiate a dispute, please note that the credit bureau is required to investigate your dispute within 45 days, as opposed to the standard 30-day timeframe.

other ways to get a free credit report

The free annual credit report is accessible to all residents of the United States. Furthermore, if you have recently been declined credit, you are entitled to obtain your credit report free of charge directly from a credit reporting agency.

Upon receiving notification of the denial, you have a 60-day window to request your credit report. Your request must be directed to the same credit reporting agency you initially used to check your credit.

Should you opt for a free state report or qualify for a complimentary credit report due to other circumstances discussed earlier, you’ll need to reach out to the nationwide credit reporting agencies directly. Equifax and TransUnion offer convenient online ordering for these free credit reports. However, to obtain your free Experian credit report, you may need to place a call.

Below is the contact information for each credit bureau:

- Free Experian Credit Report: Call (866) 200-6020 to confirm eligibility and request your credit report by mail, or use this link.

- Free Equifax Credit Report: Call (877) 322-8228 or order online through this link.

- Free TransUnion Credit Report: Call (800) 813-5604 or order online through this link.

Remember to keep track of when you order your credit reports and from which bureau(s) to ensure you know when you’ll be eligible to request your next free credit report.

Can I get a free credit score too?

Regrettably, federal law does not mandate credit bureaus to provide a complimentary credit score along with your free credit reports. However, Lexington Law Firm offers a free FICO credit score and credit repair consultation, which you can access by visiting their website. Additionally, numerous credit card companies offer free credit reports.

You can often obtain your credit score alongside your free credit report for an extra fee from credit reporting agencies. However, these credit scores are commonly referred to as FAKOs since they are not authentic FICO credit scores, which lenders typically use.

VantageScore is an alternative credit scoring model developed by credit reporting agencies to rival Fair Isaac. While some businesses and institutions utilize it, the majority still rely on FICO scores for credit decisions. Therefore, before paying for any credit score, ensure it will serve your needs effectively.

For ongoing monitoring of your credit reports and scores, you may want to explore a credit monitoring service.

Can I get more than one free credit report per year?

Even if you’ve already obtained your complimentary credit reports, you may still qualify for an additional one under the following circumstances:

- Negative outcomes stemming from your credit report, including:

- Rejection for credit or a loan

- Decline for insurance coverage

- Non-selection for employment

- Rejection for a government license or benefit, or experiencing an adverse outcome regarding either

- Decline or unfavorable actions on another account (e.g., increased interest rates on your credit accounts, denial of a credit line increase, etc.)

- Hardships that hinder the maintenance of positive credit, such as:

- Current unemployment with plans to seek employment within the next 60 days

- Receipt of or recent receipt of public welfare assistance

- Suspected inaccuracies in your credit file due to fraud or identity theft

Advantages of Additional Free Credit Reports

Although federal law grants access to a free annual credit report, it can be advantageous to request additional free credit reports to monitor your financial well-being and detect any potential signs of identity theft. Some states provide these additional free reports, simplifying the process for residents to stay informed about their credit status more frequently.

click here – How to Find Your TD Routing Number in Canada

Recognizing Signs of Identity Theft

Identity theft poses an escalating threat to individual financial well-being. Your credit report often serves as the initial indicator of such fraudulent activity. Suspicious transactions, unfamiliar accounts, or unexplained debts could signify misuse of your personal information for financial purposes. Regularly monitoring your credit reports is crucial for detecting these warning signs early and implementing preventive measures.

How can I dispute inaccurate information on my credit report?

Should you encounter inaccurate or questionable information on your credit report, you have the option to dispute these errors with the credit bureaus. Additionally, we provide complimentary credit repair letters for your convenience. If you require assistance in removing negative items from your credit reports, you may consider employing a credit repair service.

click here – Top 6 Personal Finances Newsletters to Discover in 2024

FAQ – What is the best site to get a free credit report

Q.1 How often can I get a free credit report?

You have the right to receive one complimentary credit report from each of the three major credit bureaus (Experian, Equifax, and TransUnion) every 12 months through AnnualCreditReport.com.

Q.2 Does checking my credit report hurt my credit score?

No, examining your own credit report constitutes a soft pull, which is not relayed to the credit bureaus and does not influence your credit score.

Q.3 How long does it take to get my free credit report?

The online form usually takes approximately 15 minutes to fill out before you receive your credit report.