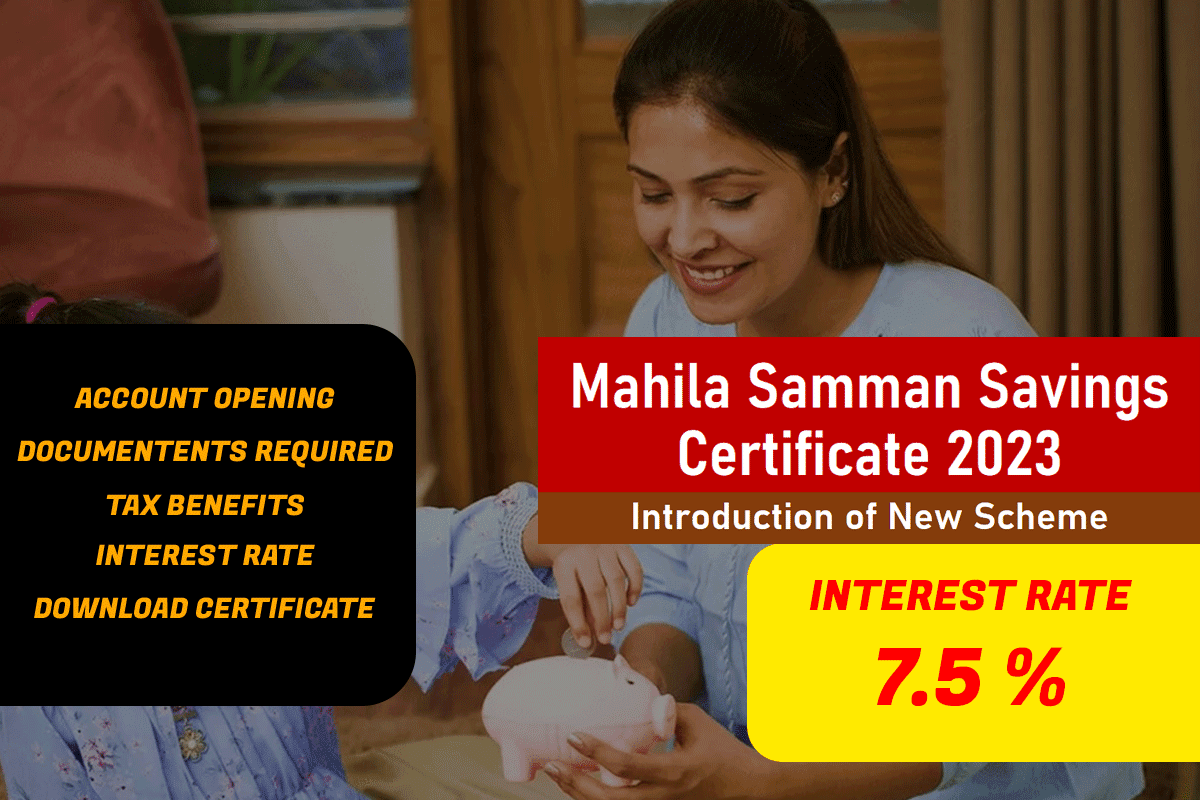

Mahila Samman Savings Certificate (MSSC), a brand-new modest savings programme, was announced by Finance Minister Nirmala Sitharaman in the Budget 2023. A woman or girl of any age may open this one-time plan in her name. Between 2023 and 2025, the Mahila Samman Savings Certificate will be offered for a two-year term. It provides a fixed interest rate of 7.5% for a two-year period.it would provide a maximum deposit facility of up to Rs. 2 lakh in the names of women or girls.

What is the Mahila Samman Saving Certificate?

In India, women can only participate in the Mahila Samman Saving Certificate programme, which is endorsed by the government. The Government of India introduced this programme in 1993 with the intention of encouraging women to save money and achieve financial independence.

Women participating in this programme can invest between Rs. 1000 and Rs. 1.5 lakhs throughout the course of a financial year. Section 80C of the Income Tax Act of 1961 allows for a tax deduction for investments made under this plan.

The Mahila Samman Saving Certificate offers an interest rate that is established by the government and has a five-year maturity period. According to my understanding, this programme offers an interest rate of 7.5 percent annually with a cutoff date of 2021. The annual interest payment made under this plan is taxed according to the investor’s income tax bracket.

It is significant to note that after one year of investment, early withdrawal of the investment is permitted with a 2% of the deposit amount penalty. Additionally, under this plan, a person may only open one account; joint accounts are not permitted.

Overall, the Mahila Samman Saving Certificate is a wonderful alternative for women who wish to save money and benefit from tax advantages while also earning a higher rate of interest. Before investing in the plan, it is crucial to comprehend all of its terms and conditions.

How many documentents required?

documents that must be opened Certificate for Mahila Samman

The documentation listed below must be supplied with the application to create a modest savings programme account at the Post Office.

1)Account Opening Form

2)KYC Form (For New Customers/Changes to KYC Information)

3)pan card

4) Aadhar card (If an Aadhaar card cannot be obtained, the following document may be provided instead)

1.Passport 2.Driving license 3. Voter’s ID card 4. Job card issued by MNREGA signed by the State Government officer 5. Letter issued by the National Population Register containing details of name and address

Can I buy Mahila Samman Savings Certificate online?

Mahila Samman Savings Certificates could not be obtained online as of the 2021 deadline, to the best of my knowledge. All throughout India, authorised post offices offered this programme.

A person had to go to a certain post office, fill out the application form, and provide the required paperwork and investment amount to invest in the Mahila Samman Savings Certificate. The certificate would subsequently be issued in the investor’s name by the post office.

However, it’s possible that since my knowledge cutoff date of 2021, the procedure has been updated and the programme is now accessible for online purchase. Therefore, it is advised to check with the closest post office or the Department of Post’s official website, Government of India, to receive the most up-to-date information on the Mahila Samman Savings Certificate purchasing procedure.

Who should invest in Mahila Samman Savings Certificate?

In India, women can only participate in the Mahila Samman Savings Certificate programme, which is supported by the government. For women who wish to save money and receive tax advantages as well as a greater rate of interest, this is a wonderful alternative.

Women should think about purchasing Mahila Samman Savings Certificates for the following reasons:

1.Higher interest rate:The interest rate on Mahila Samman Savings Certificates is greater than that on the majority of bank fixed deposit plans. The interest rate given by this programme, which I am aware of having a cutoff in 2021, was 7.5% annually.

2.Tax benefits:Section 80C of the Income Tax Act of 1961 allows for a tax deduction for investments made in Mahila Samman Savings Certificates. Accordingly, the investor may deduct up to Rs. 1.5 lakhs from their taxable income.

3.Low risk:Because Mahila Samman Savings Certificate is a government-backed programme, investing in it is secure and carries little risk.

4.Financial independence:Mahila Samman Savings Certificate investments can assist women in achieving financial independence and economic security.

5.Easy investment process:Mahila Samman Savings Certificate investments are straightforward and may be made at authorised post offices across India.

It is crucial to keep in mind that Mahila Samman Savings Certificates are subject to a number of limitations and regulations, including a five-year lock-in period and a maximum investment amount. Therefore, it is advised to carefully read this scheme’s terms and conditions before investing, as well as to compare it to other investment possibilities on the market.

Mahila Samman Savings Certificate Calculation.

The advantage of creating a Mahila Samman Savings Certificate account will now be discussed. Consider investing Rs. 2,00,000 in the programme; you would receive a set interest rate of 7.5% each year. As a result, you will receive Rs. 15,000 in interest on the principle in the first year and Rs. 16,125 in interest in the second year. As a result, after two years, you will have received 2,31,125 (2,00,000 for the initial investment plus 31,125 for interest). As a result, the maturity amount that you will receive in two years will be Rs. 2,31,125.

Mahila Samman SavingCertificate is better than other bank fixed despiot.

The comparison between Mahila Samman Savings Certificate and bank FD schemes may vary on individual circumstances and requirements, but it is vital to keep in mind that there are a number of criteria that influence whether an investment choice is suitable for a particular investor. When contrasting these two investment options, keep the following in mind:

1.Risk:

While Mahila Samman Savings Certificates are a government-backed programme and have a somewhat greater degree of risk, bank FD programmes are regarded as low-risk investment choices. However, there isn’t much danger involved with any choice.

2.Liquidity:

While Mahila Samman Savings Certificates have a five-year lock-in period, bank FD schemes have shorter lock-in periods and therefore provide better liquidity.

3.Taxation:

According to the investor’s income tax bracket, interest on bank FDs and Mahila Samman Savings Certificates is taxed. However, unlike bank FDs, an investment made in a Mahila Samman Savings Certificate qualifies for a tax deduction under Section 80C of the Income Tax Act.

4.Investment amount:

In contrast to bank FDs, which have no such cap, Mahila Samman Savings Certificates have a maximum investment sum of Rs. 1.5 lakhs every year.

Overall, both bank FDs and Mahila Samman Savings Certificates have advantages and disadvantages, and the appropriateness of each choice may depend on specific tastes and circumstances. It is essential to contrast these choices and pick the one that most closely matches a person’s financial objectives and needs.

What Happens for Premature Closure of Mahila Samman Savings Certificate?

Following specific circumstances, you may terminate your Mahila Samman Savings Certificate account before the 2-year maturity period:

- Accounts that are cancelled without giving a reason after six months of operation will earn the account holder interest at a rate of 5%.

- In the event that the account holder passes away

- if there are exceptional compassionate circumstances, such as the account holder’s life-threatening illness and the guardian’s passing after the provision of pertinent documentation. The interest will be paid on the principle sum in this scenario.

Mahila Samman Savings Certificate Vs. Sukanya Samriddhi Yojana

Small savings programmes for women, Sukanya Samriddhi Yojana (SSY) and Mahila Samman Savings Certificate, both qualify as sound investments. There are significant variations, nevertheless, that you should be aware of.

| Mahila Samman Savings Certificate | Sukanya Samriddhi Yojana |

| Dedicated to women of all ages | Dedicated to girl-child below 10 years |

| Offers 7.5% interest rate | Offers 8% interest rate |

| The maturity period is 2 years | The maturity period is 21 years or upon the marriage of the girl-child after attaining the age of 18 years |

| Minimum deposit amount of Rs.1,000 | Minimum deposit amount of Rs.250 |

FAQ – Mahila Samman savings certificate

1.Is interest on Mahila Samman saving certificate taxable?

Interest obtained under the plan is taxed. You cannot enjoy tax benefits, unlike fixed deposits that save taxes. Interest earned on Mahila Samman Savings Certificates is not tax-exempt. Depending on the overall amount of interest income and the particular tax slabs, TDS will be subtracted.

2.What is the interest rate of the Mahila Samman Savings Certificate?

The interest rate is 7.5% p.a., credited quarterly and paid at the time of closure of the account.

3.How to get Mahila Samman Saving Patra?

The post office branch where you created the Mahila Samman Saving Certificate account will be able to provide you with the Mahila Samman Saving Patra.

4.What is the benefit of the Mahila Samman Saving Certificate?

After two years, women will get a one-time deposit with 7.5% interest each year. This program’s interest rate is greater than many bank-offered two-year fixed deposit interest rates.

5.When can I invest in Mahila Samman saving certificate?

Synopsis. A single holder type account can be created at the Post Office or any licenced bank under the Mahila Samman Savings Certificate scheme.

6.Who Can Invest in Mahila Samman Savings Certificate?

Only women and girl children are eligible to invest in this small savings scheme.